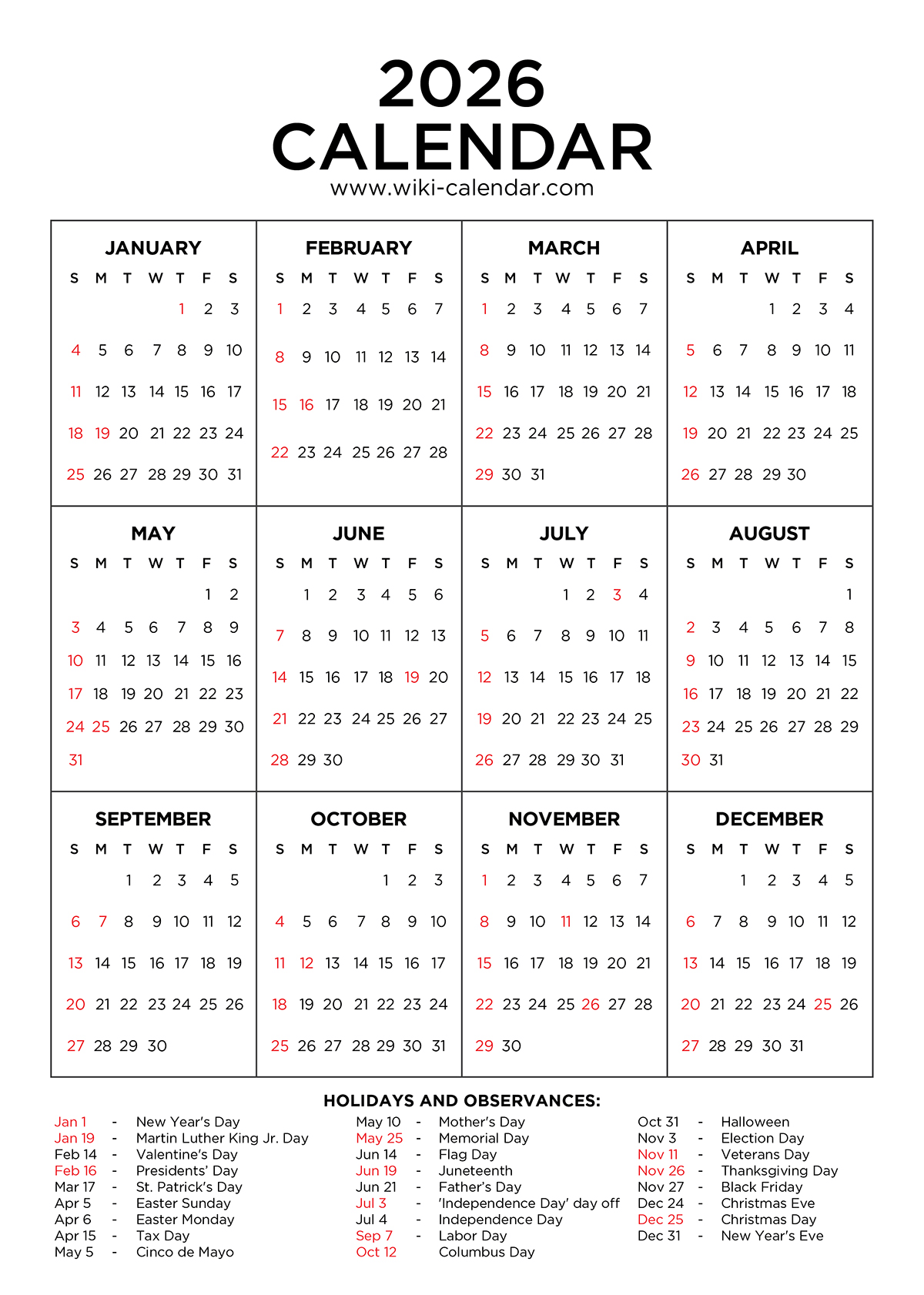

Alright, fellow millennials, let’s talk taxes. We know it’s not the most glamorous topic, but mastering your finances, especially your tax obligations, is a cornerstone of adulting and achieving true financial freedom. September can be a surprisingly busy month for tax matters, even outside of the traditional tax season. That’s why we’ve put together this comprehensive September 2026 Calendar With Important Deadlines For Taxes, specifically tailored to help you navigate the nuances with ease and confidence.

Ignoring these crucial dates can lead to unnecessary stress and those dreaded penalties. But don’t worry, this guide isn’t just a list of dates; it’s your strategic roadmap. We’re breaking down everything you need to know about the September 2026 Calendar With Important Deadlines For Taxes, from quarterly payments to extensions, all in a friendly, no-nonsense way.

The Millennial Tax Landscape in 2026: Why September Matters

Our generation faces a unique financial landscape. Many of us are balancing traditional jobs with side hustles, diving into the world of freelancing, or exploring the dynamic (and sometimes confusing) realm of cryptocurrency. These diverse income streams mean our tax situations are often more complex than previous generations.

The idea that taxes only happen once a year is a myth, especially if you’re self-employed, an entrepreneur, or have significant investment income. For many, September 2026 marks a critical juncture for fulfilling estimated tax obligations and managing extended filings. Proactive planning is not just a good idea; it’s essential for maintaining financial wellness and avoiding common tax mistakes.

Demystifying Key Tax Terms for September 2026

Before we dive into the specific dates, let’s quickly clarify some important terms you’ll encounter. Understanding these concepts is fundamental to accurate tax planning and compliance.

- Estimated Taxes (Q3): These are taxes paid throughout the year by individuals who expect to owe at least $1,000 in tax. This typically applies to income not subject to withholding, like self-employment income, interest, dividends, rent, or gains from selling assets. The third-quarter payment, due in September, covers income earned from June 1 to August 31.

- Tax Extensions: If you filed an extension for your 2025 federal income tax return (Form 1040), that extended deadline often falls in September or October. This extends the time to file, not the time to pay.

- Payroll Tax Deposits: Businesses, including those with employees (even if you’re the only employee in your S-Corp!), have specific monthly or semi-weekly deposit schedules for federal payroll taxes. September will have several such dates.

- Business Filing Deadlines: While many major business tax deadlines are earlier in the year, some specific business returns or extended corporate filings might also have September due dates.

Your Essential September 2026 Tax Deadline Calendar

Here’s your ultimate September 2026 Calendar With Important Deadlines For Taxes, designed to keep you organized and penalty-free. Mark these dates down, set reminders, and breathe easy knowing you’re on top of your game.

| Date | Who It Affects | What’s Due | Notes for Millennials |

|---|---|---|---|

| September 15, 2026 | Individuals, Self-Employed, Freelancers, Small Businesses, Corporations | Third Quarter (Q3) Estimated Tax Payment for 2026 (Form 1040-ES) | This covers income earned from June 1 to August 31. Crucial for side hustlers, gig workers, and anyone with significant income not subject to withholding. Use Form 1040-ES to calculate your payment. |

| September 15, 2026 | Calendar Year Partnerships and S-Corporations (Form 1120-S) who filed an extension | Extended due date for filing 2025 income tax returns (Form 1065 & Form 1120-S) | If you own an LLC taxed as a partnership or S-Corp and requested an extension, this is your final deadline to file. Remember, this doesn’t extend payment due dates for any tax owed. |

| September 15, 2026 | Calendar Year Corporations (Form 1120) who filed an extension | Extended due date for filing 2025 income tax returns (Form 1120) | For incorporated businesses, this is the extended deadline to submit your corporate tax return. |

| September 15, 2026 | Monthly/Semi-weekly Payroll Tax Depositors | Monthly/Semi-weekly payroll tax deposits | Employers must deposit federal income tax withheld and FICA taxes. Specific dates vary based on your deposit schedule. |

| September 30, 2026 | Employers, Certain Businesses | Filing of Form W-4, Employee’s Withholding Certificate for certain employees | For employees who claimed exemption from withholding for 2026, they must file a new Form W-4 by this date. |

Beyond the Calendar: Smart Tax Strategies for Millennials

Knowing the dates is one thing; strategizing around them is another. Here are some actionable tips to ensure you’re not just meeting deadlines but optimizing your financial situation.

Estimated Tax Game Plan: Who Needs to Pay, How to Calculate, Avoid Penalties

If you’re pulling in income from various sources, especially self-employment, you’re likely on the hook for estimated taxes. The IRS wants its share throughout the year, not just at tax season. Failing to pay enough can result in penalties, a hit nobody wants.

Who Needs to Pay? You generally need to pay estimated tax if you expect to owe at least $1,000 in tax for 2026. This includes income from side gigs, freelance projects, consulting, investments, and more. Even if you have a W-2 job, significant additional income might trigger this requirement.

How to Calculate: The easiest way to estimate is to project your annual income and deductions. Use Form 1040-ES, Estimated Tax for Individuals, as a worksheet. It guides you through estimating your adjusted gross income, deductions, credits, and ultimately, your total tax liability. Divide that amount by four for your quarterly payments.

Avoiding Penalties: The key is to pay at least 90% of your current year’s tax liability or 100% of your previous year’s tax liability (110% if your AGI was over $150,000). Adjust your payments throughout the year if your income changes. Tools like the IRS Tax Withholding Estimator can be incredibly helpful here.

Mastering the Side Hustle & Freelance Tax Code

The gig economy is booming, and so are the related tax questions. If you’re earning money outside of a traditional employer-employee relationship, you’re likely a 1099 contractor in the eyes of the IRS. This means you’re responsible for both the employer and employee portions of Social Security and Medicare taxes (known as self-employment tax).

- Track Everything: Keep meticulous records of all income and expenses related to your side hustle. Use a dedicated bank account or a financial tracking app.

- Deductible Expenses: Don’t leave money on the table! Common deductions for freelancers include home office expenses, business travel, professional development, software subscriptions, health insurance premiums (if self-employed), and even a portion of your phone and internet bills.

- Self-Employment Tax: This is currently 15.3% on your net earnings from self-employment. The good news? You can deduct one-half of your self-employment tax from your gross income.

Navigating the Crypto Tax Frontier

Cryptocurrency is no longer a niche investment; it’s a significant asset for many millennials. The IRS views crypto as property, meaning every transaction (selling, trading, using crypto for goods/services) is a taxable event. This can get complicated fast.

- Tracking Transactions: Use dedicated crypto tax software or portfolio trackers to record every buy, sell, trade, and spend. This is non-negotiable for accurate reporting.

- Capital Gains/Losses: If you sell crypto for more than you bought it, you have a capital gain. If you sell for less, you have a capital loss. Short-term gains (assets held less than a year) are taxed at ordinary income rates; long-term gains (held over a year) often qualify for lower rates.

- Reporting: All crypto transactions must be reported on Form 8949, Sales and Other Dispositions of Capital Assets, and then summarized on Schedule D, Capital Gains and Losses. Don’t forget about staking rewards or airdrops, which are typically taxed as ordinary income.

Leveraging Deductions & Credits: Don’t Leave Money on the Table

Tax deductions reduce your taxable income, while tax credits directly reduce the amount of tax you owe. Maximizing these can significantly lower your overall tax burden.

- Student Loan Interest Deduction: If you’re paying off student loans, you can deduct up to $2,500 in student loan interest.

- IRA Contributions: Contributions to a Traditional IRA are often tax-deductible, reducing your taxable income. This is a powerful tool for retirement planning.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contributions to an HSA are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are also tax-free. Triple tax advantage!

- Home Office Deduction: For self-employed individuals who use a part of their home exclusively and regularly for business, this can be a valuable deduction.

- Child Tax Credit/Child and Dependent Care Credit: If you have kids, these credits can provide substantial tax relief.

The Power of Proactive Planning: Digital Tools, Financial Advisors, Emergency Funds

The best way to tackle tax season stress is to eliminate it before it even starts. Proactive financial planning is your best friend.

- Digital Tools: Embrace technology! Use budgeting apps (Mint, YNAB), accounting software (QuickBooks Self-Employed, Wave), and tax preparation software (TurboTax, H&R Block) to keep your finances organized year-round.

- Financial Advisors: Consider consulting a CPA or financial advisor. They can offer personalized advice, help with complex situations, and ensure you’re optimizing your tax strategy. The cost often pays for itself in savings and peace of mind.

- Emergency Funds for Taxes: Set aside money for taxes in a separate savings account throughout the year. For self-employed individuals, a good rule of thumb is to save 25-35% of every payment for taxes. This prevents a mad scramble when estimated tax deadlines roll around.

Common Mistakes Millennials Make (and How to Avoid Them)

Even with the best intentions, it’s easy to stumble. Here are typical pitfalls and how to steer clear of them:

- Ignoring Quarterly Taxes: This is perhaps the biggest one. Many first-time freelancers or those new to significant investment income forget about estimated taxes until it’s too late. Pay your quarterly payments on time to avoid penalties.

- Poor Record-Keeping: Scrambling for receipts and invoices at tax time is a nightmare. Implement a system, digital or physical, to track all income and expenses as they occur.

- Missing Out on Deductions: Not knowing what you can deduct is like leaving money on the table. Educate yourself on common deductions for your situation and keep records to back them up.

- Waiting Until the Last Minute: This leads to rushed decisions, potential errors, and unnecessary stress. Start gathering documents and planning well in advance of deadlines.

- Underestimating State Tax Obligations: Federal taxes are just one part of the equation. Remember that state income tax deadlines can be different and vary by state. Always check your specific state’s requirements.

Leveraging Technology for Tax Efficiency

In 2026, there’s no excuse for manual, spreadsheet-only tax tracking. Technology has revolutionized personal finance.

- Tax Software: Platforms like TurboTax, H&R Block, and TaxAct offer user-friendly interfaces that walk you through the filing process. Many can import financial data directly from banks and other institutions.

- Accounting Software: For freelancers and small businesses, QuickBooks Self-Employed or Wave Accounting can categorize expenses, track mileage, and even help you estimate quarterly taxes.

- Budgeting Apps: Tools like Mint, YNAB (You Need A Budget), or Personal Capital help you understand your cash flow, identify spending patterns, and allocate funds for future tax payments. Integrating these into your routine is a game-changer for financial planning.

- Secure Document Storage: Use cloud services (Google Drive, Dropbox, OneDrive) or dedicated document management systems to safely store digital copies of tax documents, receipts, and important financial records.

Expert Insights: When to Call in a Pro

While DIY tax prep is increasingly accessible, there are times when the expertise of a professional is invaluable. Don’t hesitate to seek help when:

- Your Tax Situation is Complex: Multiple income streams, significant investments (especially crypto), owning rental properties, international income, or experiencing major life changes (marriage, divorce, starting a business) can warrant professional guidance.

- You Want to Maximize Savings: A good tax professional can identify deductions and credits you might miss, often saving you more than their fee.

- You’re Short on Time or Knowledge: If the thought of tax preparation fills you with dread, or you simply don’t have the bandwidth, outsourcing it can be a wise investment in your time and peace of mind.

- You’re Facing an Audit or Need to Amend a Return: These situations require expert navigation and representation.

Look for a Certified Public Accountant (CPA) or an Enrolled Agent (EA) with experience in situations similar to yours, particularly those involving small business taxes or complex investment portfolios.

FAQ Section: Your Burning Tax Questions Answered

What happens if I miss a September 15th deadline for estimated taxes?

If you fail to pay enough estimated tax by the due date, you may be charged a penalty for underpayment of estimated tax. The penalty can be avoided if you paid at least 90% of the tax due for the current year or 100% of the tax shown on your return for the prior year (110% if your AGI was over $150,000).

How do I pay my estimated taxes?

You can pay estimated taxes online through IRS Direct Pay, by mail with Form 1040-ES payment vouchers, or through the Electronic Federal Tax Payment System (EFTPS). Most tax software also allows you to make estimated tax payments directly.

Are state tax deadlines different from federal deadlines?

Yes, absolutely. While many states align with federal deadlines, it’s crucial to check your specific state’s tax agency website for their particular due dates for estimated taxes, income tax returns, and other state-specific filings. Don’t assume they are the same!

Can I get an extension for estimated taxes?

No, the IRS does not grant extensions for estimated tax payments. Estimated taxes are due quarterly throughout the year. If you anticipate difficulty meeting a payment, you should adjust your withholding or make the payment as soon as possible to minimize potential penalties.

What records should I keep for tax purposes?

Keep records of all income (W-2s, 1099s, bank statements for self-employment), expense receipts (especially for business deductions), investment statements, mileage logs, charitable donation receipts, and any other document that supports an item on your tax return. Keep these for at least three years from the date you filed your return or two years from the date you paid the tax, whichever is later.

Final Conclusion: Own Your September 2026 Tax Destiny

Navigating the world of taxes doesn’t have to be a source of anxiety. By using this September 2026 Calendar With Important Deadlines For Taxes as your guide and implementing the proactive strategies we’ve discussed, you can move from feeling overwhelmed to empowered. Remember, staying organized, understanding your obligations, and leveraging the right tools are your keys to financial peace of mind.

Take control of your financial destiny, meet your deadlines, and free up your mental energy for what truly matters to you. Happy planning, millennials!