Hey there, future financial rockstar! Is your money strategy feeling a little… last year? As a certified financial planner who’s navigated the unique financial landscape of the millennial generation, I know the struggle is real. From student loans to soaring housing costs and the ever-present desire for both avocado toast and a stable retirement, balancing today’s joys with tomorrow’s security can feel like a Herculean task.

But what if I told you that June 2026 is actually the perfect mid-year checkpoint to fine-tune your financial GPS and ensure you’re on the fast track to achieving your aspirations? This isn’t just another financial lecture; it’s your comprehensive, actionable June 2026 Financial Planning Checklist designed specifically for you. Let’s make some smart money moves together!

Why June 2026 is Your Prime Time for Financial Reflection

The middle of the year isn’t just for summer plans and vacation dreaming; it’s a golden opportunity for a mid-year financial review. Think of it as hitting pause, assessing your progress, and making necessary adjustments. This allows you to identify what’s working, what’s not, and how to course-correct before the year ends.

For millennials, this proactive approach is even more critical. We face unique economic challenges and opportunities that demand a modern, dynamic financial strategy. Ignoring your finances now could mean missing out on significant wealth building potential later.

The Millennial Money Mindset: Challenges and Opportunities

Let’s be honest: our generation has a lot on its plate. We often juggle significant student loan debt, rising housing costs, and a constant battle against inflation. These factors can make traditional financial advice feel out of touch or even impossible to implement.

However, we also have powerful advantages. As digital natives, we’re adept at leveraging technology for financial tools and apps. We’re innovators, often embracing side hustles and actively pursuing financial independence. Our journey is unique, and our financial planning should reflect that.

Seizing the Mid-Year Advantage

June 2026 offers a strategic moment for several reasons. You have a clear six-month track record of income and expenses to analyze, providing valuable data for your budget review. This allows for realistic adjustments to your financial goals and investment strategy.

It’s also an ideal time to assess the current economic outlook and market trends. Are interest rates shifting? Is inflation impacting your purchasing power? A mid-year check-up allows you to react thoughtfully and ensure your finances are resilient, even amidst market volatility.

The Ultimate June 2026 Financial Planning Checklist: Your Action Plan

Alright, let’s dive into the core of it all. This comprehensive checklist is designed to cover every essential area of your personal finances. Each step is actionable and geared towards helping you achieve your unique financial wellness goals.

Step 1: Revisit Your Budget & Cash Flow

Your budget is the bedrock of your financial health. June 2026 is the perfect time to pull up your bank statements and budgeting app data from the past six months. Conduct a thorough spending analysis to identify where your money is truly going.

Are there subscriptions you no longer use? Can you cut back on discretionary spending in certain areas? Also, review your income streams. Have there been any changes, or opportunities to increase them through a raise or a new side hustle? Understanding your cash flow is crucial for making informed decisions.

Step 2: Emergency Fund Check-Up

An emergency fund is your financial safety net, typically covering 3-6 months of essential living expenses. In today’s economic climate, some expert advice suggests aiming for even more, like 6-12 months. Review your current savings and compare it against your revised monthly expenses.

Are you meeting your target? If not, make a concrete plan to bolster it. Set up automatic transfers to your savings account, treating it like a non-negotiable bill. This ensures you’re prepared for unexpected events without derailing your long-term financial goals.

Step 3: Supercharge Your Savings Goals

Beyond your emergency fund, what are you saving for? Whether it’s a down payment on a home, a dream vacation, or further education, June is the time to check on your progress. Are you on track for your short-term goals? What about those important long-term goals?

Consider automating transfers to separate savings accounts for each goal. This psychological trick makes saving feel less like a chore and more like achieving progress. Remember the power of compound interest – even small, consistent savings add up significantly over time.

Step 4: Decode Your Debt: Strategy for Freedom

Debt can feel like a heavy burden, especially for millennials. Use this June 2026 Financial Planning Checklist moment to create a concrete debt repayment plan. List out all your debts: student loans, credit cards, auto loans, and any personal loans.

Focus on high-interest debts first using strategies like the debt snowball or avalanche method. Can you refinance your student loans or consolidate high-interest credit cards? Understanding your interest rates and payment terms is the first step towards financial freedom from debt.

Step 5: Optimize Your Investments for Growth

This is where your money starts working for you! Take a good look at your investment portfolio. Are your asset allocations still aligned with your risk tolerance and long-term goals? A mid-year review is perfect for portfolio rebalancing if needed.

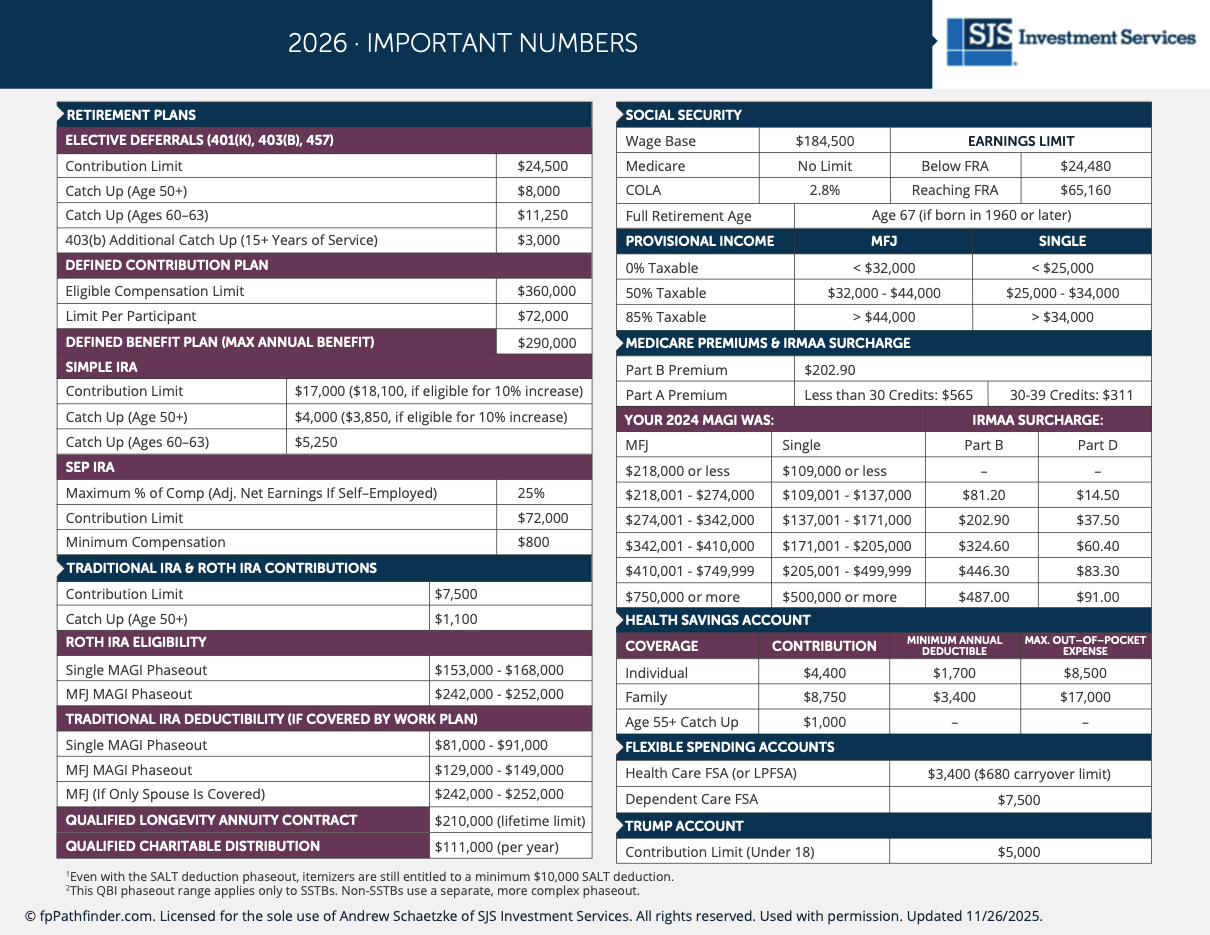

Check on your retirement accounts like your 401k and Roth IRA. Are you maximizing your contributions, especially if your employer offers a match? Explore different investment vehicles, including the potential for digital assets or more tax-efficient investing strategies. Remember, diversification is key to mitigating risk.

| Investment Growth Scenario (Hypothetical) | Initial Investment | Annual Contribution | Avg. Annual Return | Value After 10 Years | Value After 20 Years |

|---|---|---|---|---|---|

| Scenario A: Consistent Saver | $5,000 | $2,400 ($200/month) | 7% | $39,400 | $124,000 |

| Scenario B: Aggressive Investor | $10,000 | $6,000 ($500/month) | 8% | $107,000 | $439,000 |

| Scenario C: Late Starter | $1,000 | $1,200 ($100/month) | 6% | $19,000 | $45,000 |

Disclaimer: These figures are hypothetical and for illustrative purposes only. Actual returns may vary.

Step 6: Master Your Credit Score

Your credit score is a powerful number. It impacts everything from getting a mortgage or auto loan to renting an apartment or even securing certain jobs. June is a great time to pull your free credit reports from all three major bureaus (Experian, Equifax, TransUnion).

Review them for any errors or fraudulent activity. Understand the factors that influence your score: payment history, credit utilization, length of credit history, new credit, and credit mix. Work on improving it if needed, as a good score saves you thousands in interest rates over your lifetime.

Step 7: Plan for the Future: Retirement & Beyond

It might seem far off, but retirement planning needs to start now. The earlier you begin, the more time compound interest has to work its magic. Beyond your 401k and Roth IRA, consider other investment vehicles to build long-term wealth.

Also, don’t neglect other aspects of future planning. This includes reviewing your insurance coverage (health, auto, home, life, disability) to ensure it’s adequate for your current life stage. While it may seem premature, understanding the basics of estate planning (e.g., a simple will) is also part of being financially responsible.

Step 8: Tax Planning & Efficiency

Don’t wait until April to think about taxes! A mid-year review allows you to make smart tax planning adjustments. Have you had any significant life changes (marriage, new child, new job) that impact your tax situation? Are you withholding the correct amount from your paycheck?

Look for opportunities for tax-efficient investing, like contributing to an HSA (Health Savings Account) if eligible, or optimizing capital gains. Consulting with a tax professional can ensure you’re taking advantage of all eligible deductions and credits, saving you money in the long run.

Step 9: Level Up Your Financial Literacy

The financial world is constantly evolving, and so should your knowledge! Make a commitment in June 2026 to enhance your financial education. Read books on personal finance, follow reputable financial advisors or blogs, or even take an online course.

Understanding concepts like asset allocation, market volatility, and inflation hedges empowers you to make better decisions. The more you learn, the more confident and capable you’ll become in managing your money and building your wealth.

Beyond the Basics: Advanced Strategies for Wealth Building

Once you’ve got the fundamentals locked down with our June 2026 Financial Planning Checklist, it’s time to explore avenues for accelerating your financial growth. These strategies can help you move from simply managing your money to actively building your empire.

Exploring Passive Income & Side Hustles

Millennials are masters of the side hustle, and for good reason! Generating passive income streams can significantly boost your cash flow and accelerate your journey to financial independence. Think about skills you have that can be monetized, or consider investments that generate income, such as dividend stocks or real estate.

From freelance writing to creating digital products or even investing in a rental property, the options are vast. Diversifying your income reduces reliance on a single source and provides a cushion against economic uncertainties.

Navigating Market Volatility & Economic Outlook

The global economy is always in motion, and staying informed is crucial. Pay attention to the economic forecasts and understand how factors like inflation and interest rates might impact your investments and purchasing power. Develop strategies to protect your assets during periods of market volatility.

This might involve having a well-diversified portfolio across different asset classes, considering alternative investments, or having a higher cash reserve. Being prepared means you can weather storms and even find opportunities when others are panicking.

The Power of Financial Advisors

While this guide provides a strong foundation, there comes a point where expert advice can be invaluable. A qualified financial advisor can offer personalized strategies tailored to your specific circumstances and complex goals. They can help with everything from advanced tax planning to estate planning and sophisticated investment strategies.

Look for fiduciaries who are legally obligated to act in your best interest. Don’t be afraid to interview several advisors to find one whose approach aligns with your financial journey and values. Their expertise can provide clarity and peace of mind.

Data-Driven Insights for Your June 2026 Financial Journey

Understanding where you stand in relation to broader trends can be motivating and help you set realistic goals. Let’s look at some hypothetical data points that reflect typical millennial financial landscapes and milestones.

| Millennial Financial Snapshot (Hypothetical, June 2026) | Average Debt (excluding mortgage) | Average Savings Account Balance | Average Investment Portfolio Value | % with Emergency Fund (3+ months) |

|---|---|---|---|---|

| Ages 25-30 | $45,000 | $8,500 | $15,000 | 40% |

| Ages 31-35 | $60,000 | $12,000 | $40,000 | 55% |

| Ages 36-40 | $55,000 | $18,000 | $90,000 | 65% |

Source: Simulated data based on general economic trends and financial surveys. Individual results will vary.

| Key Financial Milestones by Age (Suggested Targets) | Age 30 | Age 35 | Age 40 |

|---|---|---|---|

| Net Worth (excluding home equity) | 0.5-1x Annual Salary | 1.5-2x Annual Salary | 3-4x Annual Salary |

| Retirement Savings | 1x Annual Salary | 2x Annual Salary | 3x Annual Salary |

| Emergency Fund | 6 months expenses | 6 months expenses | 6 months expenses |

Source: General financial guidelines, for illustrative purposes only.

Common Questions About Your June 2026 Financial Planning Checklist (FAQ)

Q1: Why is June specifically important for financial planning?

June marks the halfway point of the year, making it an ideal time for a mid-year review. You have six months of data to analyze, allowing you to assess your progress, make necessary adjustments, and pivot your strategy for the remaining half of the year. It’s about course correction and optimizing your financial plan before year-end.

Q2: How often should I review my finances?

While a comprehensive annual or mid-year financial review (like in June 2026) is crucial, you should check in on your budget and investments more frequently. A monthly check-in on your cash flow and spending, and a quarterly look at your investment portfolio, can help you stay on track and prevent small issues from becoming big problems.

Q3: What if I’m behind on my financial goals?

It’s okay! Many people find themselves off track at some point. The important thing is to not get discouraged. Use this June 2026 Financial Planning Checklist to honestly assess why you’re behind and create a realistic, actionable plan to catch up. Focus on small, consistent steps and celebrate your progress.

Q4: Should I prioritize paying off debt or investing?

This is a classic question with a nuanced answer. Generally, it’s wise to pay off high-interest debt (like credit card debt over 8-10%) before aggressively investing, as the guaranteed return of avoiding that interest often outweighs potential investment gains. However, always contribute enough to your 401k to get any employer match – that’s essentially free money!

Final Thoughts: Your Path to Financial Freedom Starts Now

Taking control of your finances might seem overwhelming at first, but remember, every large goal is achieved through a series of small, consistent steps. The June 2026 Financial Planning Checklist is more than just a list; it’s a powerful tool to empower you on your journey to financial independence and lasting wealth.

As a financial professional, I’ve seen firsthand how a proactive approach transforms lives. You have the power to shape your financial future. Start today, stay disciplined, and watch your money goals become reality. Your future self will thank you for taking these crucial steps now!