Hey there, future financial rockstars! As we roll into August 2026, it’s clear that the world of money management is constantly evolving. For millennials navigating student loans, career shifts, and the dream of financial freedom, staying on top of your game is not just an option—it’s a necessity. This comprehensive guide is packed with essential financial literacy tips to help you optimize your wealth building strategies and achieve robust financial health.

We’re diving deep into practical, actionable advice that resonates with our generation’s unique challenges and aspirations. From smart budgeting apps to future-proof investment strategies, this pillar page will empower you to take control of your economic well-being. Get ready to transform your approach to money management and secure your financial future.

Understanding the Millennial Financial Landscape in August 2026

The economic outlook for August 2026 presents both opportunities and hurdles. Inflation rates, evolving job markets, and technological advancements continue to shape our financial realities. Many millennials are still grappling with student loan debt, the rising cost of living, and the challenge of homeownership.

Despite these challenges, our generation is also characterized by a strong desire for financial security, flexible work, and a commitment to long-term goals. Understanding these dynamics is the first step towards effective money management. We’ll explore how these factors influence your personal finance decisions and what strategies you can adopt to thrive.

Key Financial Challenges & Opportunities for Millennials

-

Debt Burden: Student loans remain a significant factor, impacting credit scores and delaying other financial milestones.

-

Cost of Living: Housing and daily expenses continue to rise, necessitating smart budgeting and savings strategies.

-

Investment Access: Digital tools and robo-advisors have made investing more accessible, democratizing wealth building.

-

Gig Economy: The rise of side hustles and freelance work offers new avenues for passive income and financial growth.

-

Financial Literacy Gap: Many feel unprepared to manage complex financial products, highlighting the need for comprehensive education.

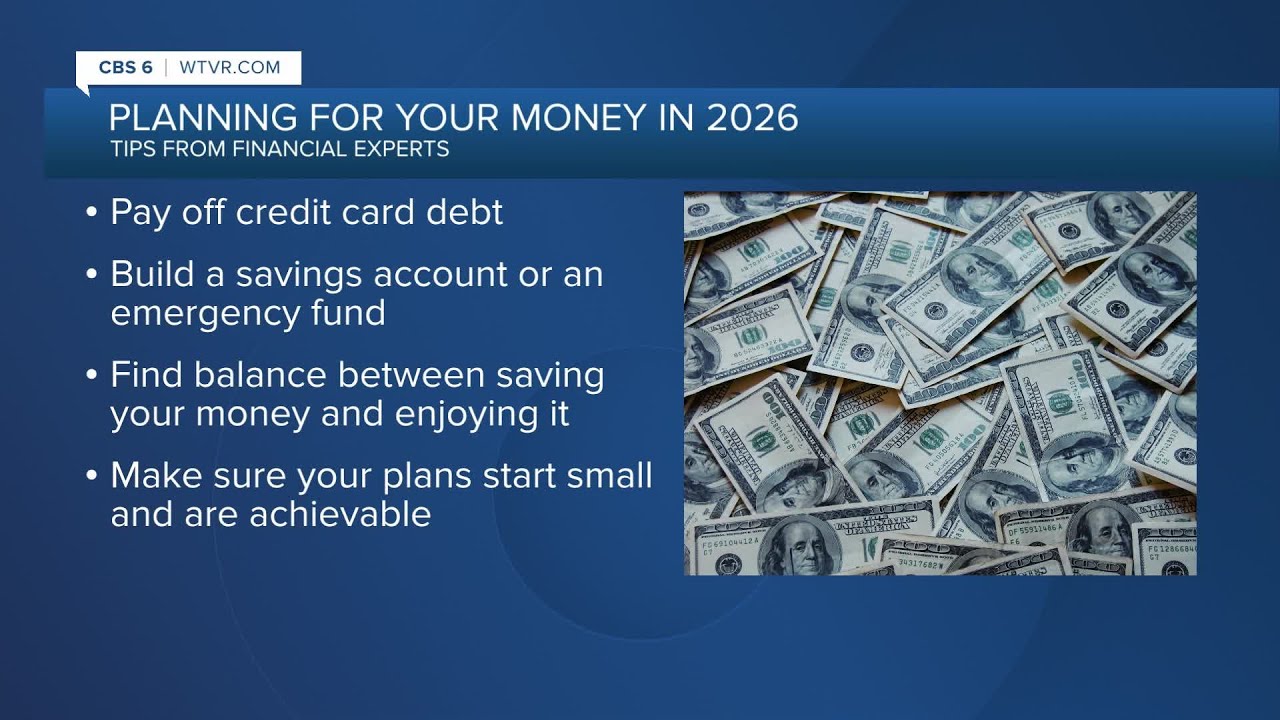

Pillar 1: Mastering Your Budget – The Foundation of Money Management

Budgeting isn’t about restriction; it’s about empowerment. It’s your personalized roadmap to understanding where your money goes and intentionally directing it towards your financial goals. In August 2026, there’s no excuse not to have a clear budget.

Effective budgeting forms the bedrock of all sound financial decisions. It helps you identify wasteful spending, allocate funds for savings and investments, and manage debt proactively. Think of it as your financial GPS, guiding you to your desired destination.

Budgeting Strategies That Actually Work for Millennials

Forget complex spreadsheets if they intimidate you. Modern budgeting uses smart tools and flexible frameworks. The goal is to make it sustainable, not a one-time chore. Here’s how to create a budget that supports your financial aspirations.

-

The 50/30/20 Rule: A popular and easy framework. Allocate 50% of your after-tax income to Needs (housing, groceries, utilities), 30% to Wants (entertainment, dining out), and 20% to Savings & Debt Repayment. This simple rule provides a great starting point for many.

-

Zero-Based Budgeting: Every dollar has a job. This method assigns every cent of your income to an expense, saving, or debt payment. It requires more discipline but offers ultimate clarity and control over your cash flow.

-

App-Assisted Budgeting: Leverage digital tools like Mint, YNAB (You Need A Budget), or Personal Capital. These apps connect to your bank accounts, categorize transactions automatically, and provide real-time insights. They are invaluable for tracking expenses effortlessly.

Budgeting Breakdown Example for a Young Professional

Let’s visualize how the 50/30/20 rule might look for a millennial earning $4,000 net income per month:

| Category | Percentage | Monthly Allocation | Typical Examples |

|---|---|---|---|

| Needs | 50% | $2,000 | Rent, Groceries, Utilities, Car Payment, Insurance |

| Wants | 30% | $1,200 | Dining Out, Entertainment, Subscriptions, Travel |

| Savings & Debt Repayment | 20% | $800 | Emergency Fund, Investments, Student Loan Extra Payments |

This table illustrates a balanced approach to spending and saving, crucial for achieving financial stability and growth.

Pillar 2: Smart Saving & Emergency Funds – Building Your Financial Buffer

Saving isn’t just for a rainy day; it’s for securing your future, seizing opportunities, and achieving financial independence. An emergency fund is non-negotiable for robust financial health. It provides a safety net against unexpected expenses like job loss or medical emergencies.

Without an adequate emergency fund, you might be forced into high-interest debt when life throws a curveball. Building this buffer should be a top priority before focusing on aggressive investing. It’s the foundational layer of your wealth-building pyramid.

Setting Up Your Emergency Fund & Savings Goals

Financial experts generally recommend having 3 to 6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. For greater security, some even suggest 9 to 12 months. This fund should be separate from your regular checking account.

-

Automate Savings: Set up automatic transfers from your checking to your savings account on payday. ‘Set it and forget it’ is a powerful strategy. Even small, consistent contributions add up significantly over time.

-

Identify Savings Goals: Beyond emergencies, what are you saving for? A down payment on a house, a new car, a dream vacation, or early retirement? Assigning a purpose to your savings makes them more tangible and motivating.

-

High-Yield Savings Accounts: Shop around for accounts that offer competitive interest rates. Online banks often provide better yields than traditional brick-and-mortar institutions. Every bit of interest helps your money grow.

-

Review & Adjust: Periodically review your savings goals and progress. Life changes, and so should your financial plan. Reassess your contributions and adjust as your income or expenses evolve.

Pillar 3: Strategic Investing for Long-Term Growth

Investing is where your money starts working for you, creating true wealth over time. For millennials, starting early is a huge advantage due to the power of compound interest. Even modest contributions can grow substantially over decades.

Don’t be intimidated by the stock market. With the right knowledge and tools, investing can be straightforward and incredibly rewarding. The key is consistency, diversification, and a long-term perspective. Avoid chasing short-term gains and focus on proven strategies.

Millennial-Friendly Investment Avenues in August 2026

The investment landscape has diversified, offering numerous options suitable for different risk tolerances and financial goals. Here are some popular and effective strategies.

-

Retirement Accounts (401(k) & Roth IRA): Maximize these tax-advantaged accounts first. A 401(k) often comes with employer matching, which is essentially free money. Roth IRAs offer tax-free withdrawals in retirement, a huge benefit for future planning.

-

Index Funds & ETFs: These low-cost, diversified funds track a market index (like the S&P 500) and are excellent for beginners. They offer broad market exposure without requiring you to pick individual stocks. They simplify the investment process significantly.

-

Robo-Advisors (e.g., Betterment, Wealthfront): These platforms use algorithms to manage your investments based on your risk tolerance and goals. They offer professional portfolio management at a fraction of the cost of a human advisor, ideal for those just starting out.

-

Real Estate Investing: Beyond traditional homeownership, consider REITs (Real Estate Investment Trusts) or crowdfunding platforms for exposure to real estate without the direct management hassle. These options lower the barrier to entry for many.

-

Diversification is Key: Never put all your eggs in one basket. Spread your investments across different asset classes (stocks, bonds, real estate) and sectors to mitigate risk. A diversified portfolio is more resilient to market fluctuations.

Projected Investment Growth Over Time (Illustrative)

This table demonstrates the power of compound interest with consistent monthly investments. The figures are illustrative and do not guarantee actual returns, which vary based on market conditions and investment choices.

| Monthly Contribution | Annualized Return (Avg.) | After 10 Years | After 20 Years | After 30 Years |

|---|---|---|---|---|

| $200 | 7% | ~$34,400 | ~$103,400 | ~$245,600 |

| $400 | 7% | ~$68,800 | ~$206,800 | ~$491,200 |

| $800 | 7% | ~$137,600 | ~$413,600 | ~$982,400 |

The numbers clearly show that starting early and being consistent makes a monumental difference in your long-term wealth accumulation. Don’t delay your investment journey!

Pillar 4: Debt Management & Credit Score Optimization

Debt, especially high-interest debt, can be a major roadblock to financial freedom. Effectively managing and reducing your debt is a crucial component of financial literacy. It frees up cash flow and improves your overall financial health.

Your credit score is also a vital metric, impacting everything from loan approvals to housing applications. Understanding how to build and maintain excellent credit is paramount. A strong credit score opens doors to better financial products and lower interest rates.

Strategies for Tackling Debt & Boosting Your Credit Score

There are proven methods to systematically reduce debt and build a robust credit profile. It requires discipline but the rewards are significant.

-

Prioritize High-Interest Debt: Focus on paying off credit card debt or personal loans first. The ‘debt avalanche’ method (paying highest interest rate first) saves you the most money in the long run. The ‘debt snowball’ method (paying smallest balance first) provides psychological wins.

-

Consolidate & Refinance: Explore options to consolidate multiple debts into one loan with a lower interest rate, or refinance student loans if interest rates are favorable. This can simplify payments and reduce your overall interest burden.

-

Automate Payments: Never miss a payment. Set up automatic payments for all your debts to avoid late fees and protect your credit score. Payment history is the biggest factor in your FICO score.

-

Monitor Your Credit Report: Regularly check your credit report from all three major bureaus (Equifax, Experian, TransUnion) for errors. You can get a free report annually at AnnualCreditReport.com. Correcting errors can significantly boost your score.

-

Keep Credit Utilization Low: Aim to use no more than 30% of your available credit on any credit card. Lower utilization demonstrates responsible credit management and positively impacts your score.

-

Build a Long Credit History: The longer your accounts are open and in good standing, the better. Avoid closing old credit cards unless absolutely necessary. This contributes to a strong credit age.

Average FICO Score Ranges & Their Implications

| FICO Score Range | Rating | Implication |

|---|---|---|

| 300-579 | Poor | Very difficult to get approved for loans; high interest rates. |

| 580-669 | Fair | May qualify for some loans, but with higher interest rates. |

| 670-739 | Good | Considered average; generally good approval odds. |

| 740-799 | Very Good | Above average; access to better interest rates and products. |

| 800-850 | Exceptional | Excellent borrower; best rates and terms available. |

Striving for a ‘Good’ or ‘Very Good’ score should be a continuous financial literacy goal for every millennial.

Pillar 5: Leveraging Digital Tools & Financial Technology

The digital age has revolutionized money management, offering unparalleled convenience and insight. In August 2026, a myriad of financial technology (FinTech) tools are at your fingertips to streamline budgeting, investing, and financial planning. Embracing these tools is a hallmark of modern financial literacy.

From AI-driven savings apps to micro-investing platforms, FinTech empowers you to automate processes, gain clarity, and make smarter decisions. These tools are designed to be user-friendly and integrate seamlessly into your daily life.

Must-Have FinTech Tools for Savvy Millennials

-

Budgeting Apps (Mint, YNAB, Personal Capital): As mentioned earlier, these apps aggregate your accounts, track spending, and help you stick to your budget. They provide a holistic view of your financial life.

-

Micro-Investing Apps (Acorns, Robinhood, Stash): Start investing with small amounts, often by rounding up spare change from purchases. These apps make investing accessible and unintimidating for beginners. They promote consistent, small contributions.

-

Debt Management Apps (Undebt.it, Tally): Tools that help you visualize your debt repayment plan, apply strategies like the avalanche or snowball method, and automate payments. They provide structure and motivation to pay off debt faster.

-

Financial Planning Software (Quicken, Empower (formerly Personal Capital)): For a more comprehensive approach, these platforms offer in-depth analysis of your net worth, retirement planning, and investment performance. They can help you visualize your long-term financial trajectory.

-

AI-Powered Savings Tools (Digit, Chime): These apps analyze your spending habits and automatically save small, appropriate amounts for you, often without you even noticing. They make saving effortless and consistent.

Pillar 6: Continuous Financial Education & Future Planning

Financial literacy isn’t a destination; it’s a lifelong journey. The economic landscape, investment options, and tax laws are constantly changing. Staying informed is crucial for adapting your money management strategies and ensuring long-term financial security.

Invest in your financial education by reading reputable blogs, listening to podcasts, and consulting with qualified financial advisors. Proactive learning helps you anticipate challenges and capitalize on new opportunities.

Preparing for the Future: Long-Term Financial Planning

-

Retirement Planning: Start early! Even if retirement feels decades away, consistent contributions to your 401(k) or IRA will yield immense returns due to compounding. Review your retirement goals regularly.

-

Estate Planning: While often overlooked by younger generations, having a will, power of attorney, and considering beneficiaries for your accounts is important as you accumulate assets. It ensures your wishes are respected.

-

Insurance Coverage: Assess your needs for health, life, disability, and property insurance. Adequate coverage protects your assets and your loved ones from unforeseen circumstances. Don’t skimp on protection.

-

Diversify Income Streams: Consider side hustles, passive income opportunities (e.g., rental property, royalties, high-yield savings), or skill development to increase your earning potential. Multiple income sources add resilience to your financial plan.

-

Seek Professional Advice: For complex financial situations or major life events (marriage, children, business ventures), consult a fee-only financial advisor. They can provide personalized guidance and create a tailored financial plan for you.

Frequently Asked Questions (FAQ) about August 2026 Financial Literacy

Q1: What’s the most critical financial step for millennials in August 2026?

A1: The most critical step is to establish a solid budget and build an emergency fund of 3-6 months’ living expenses. This foundation provides stability and allows you to pursue other financial goals without stress. It’s the essential groundwork for all subsequent wealth building.

Q2: How much should I be saving from each paycheck?

A2: While the 50/30/20 rule suggests 20% for savings and debt repayment, aim for at least 15% of your gross income towards retirement and other long-term savings. The more you can save, especially early on, the more significant the impact of compound interest. Consistency is more important than the exact percentage.

Q3: Are cryptocurrency investments still relevant for long-term growth?

A3: Cryptocurrency remains a volatile asset class. While it can offer high returns, it also carries significant risk. Financial experts suggest keeping crypto a small, speculative portion (e.g., 1-5%) of a well-diversified portfolio, only after traditional investments are secured. It’s not a primary wealth-building tool for most.

Q4: How can I improve my credit score quickly?

A4: Focus on paying all bills on time, reducing your credit card balances to below 30% utilization, and correcting any errors on your credit report. While quick fixes are rare, consistent responsible behavior will gradually improve your score over several months. Building good credit is a marathon, not a sprint.

Final Conclusion: Empowering Your Financial Journey in August 2026

As we wrap up our deep dive into August 2026 Financial Literacy Tips Money Management, remember that your financial journey is uniquely yours. By applying these practical strategies—from disciplined budgeting and strategic saving to smart investing and proactive debt management—you’re not just managing money; you’re building a future of financial freedom and peace of mind.

Embrace the digital tools available, commit to continuous learning, and don’t be afraid to seek expert advice when needed. The power to create a thriving financial life is in your hands. Start today, stay consistent, and watch your financial dreams become a reality. Here’s to a prosperous future!